Critical to B2B sales success - stakeholder assessments

One of the most common reasons why apparently promising B2B sales opportunities get derailed - often at a late stage in our sales cycle - is that we have failed to identify all the key stakeholders or to understand how to get them all to support our approach.

There’s a similar explanation for why many accounts fail to realise their potential - we end up becoming over reliant on a few regular contacts and fail to identify or engage with the other stakeholders that could enable us to maximise our opportunities.

It’s a sad fact that many deals that are currently being forecasted to close before the end of the year will fade away or be lost for the same reason. So, this is probably a timely opportunity to remind ourselves of the critical importance of identifying, understanding and engaging all the stakeholders that our sales success must ultimately depend on…

It’s often easier, of course, to master a transactional sales environment or a low value sale with relatively few stakeholders, and life is often simpler in a situation where we have already done business with the prospect and have established a positive reputation.

If we cannot align all key stakeholders, their decision is to stick with the status quo.

Stakeholder management is important even in these situations, but it becomes critical when attempting to sell a complex, high value solution to an organisation that we have never done business with before, and it’s even more vital when the sale is a discretionary purchase sale where the prospect could easily decide to do nothing and stick with the status quo.

In fact, if we cannot identify, engage and align all the key stakeholders in these sort of deals, the most likely outcome - and our strongest competitor - is often a decision to simply stick with the status quo. It’s no wonder that fewer than 50% of forecasted deals close as predicted, or that this figure is often dramatically lower for complex B2B sales into new customers.

This is important at any time, but with one month to go before the end of the sales year, managing stakeholders effectively could turn out to be the single most important factor that ends up separating sales success from failure.

First, identify them...

So, what do we need to know and do? First, we need to identify all the stakeholders who will have some sort of meaningful say in whether the project should go ahead, and if so, with who. In many cases, this is easier said than done. “Invisible stakeholders” can often have a material - sometimes critical - impact on the decision.

As a rule of thumb, and according to the latest research from the CEB (now part of Gartner) the typical complex B2B buying decision now involves an average of 6.8 actively engaged stakeholders - and frequently many more. If we haven’t identified at least this number of engaged stakeholders, it’s a sign that we are probably missing some significant decision makers.

But it’s not just the absolute number of stakeholders: in typical complex buying processes, there are a range of perspectives that need to be represented in the decision team - typically including strategic, financial, operational, technical and contractual factors. Sometimes one individual may represent more than one perspective - but it’s equally likely that a number of members of the team will represent a single perspective.

If we can’t identify anyone to represent one or more of these perspectives, it’s a probable sign that we haven’t identified all the stakeholders, or that the prospective customer’s decision-making process (assuming one actually exists) is flawed and therefore unlikely to result in a positive decision.

We also need to ensure that we have identified at least one final approver - the person (or the final approval group) who must say yes before the project can proceed, and who sometimes may not have had any obvious involvement in the detailed decision-making process up to that point.

Asking key discovery questions such as “who has been involved in similar decisions previously”, “who else is likely to be affected by this project”, “walk me through all the steps involved in approving this project” and “who else has to approve this project” can help. If your current prime contact cannot easily answer these questions, it’s a pretty clear indication that they are unlikely to be a potential power sponsor.

Five key factors

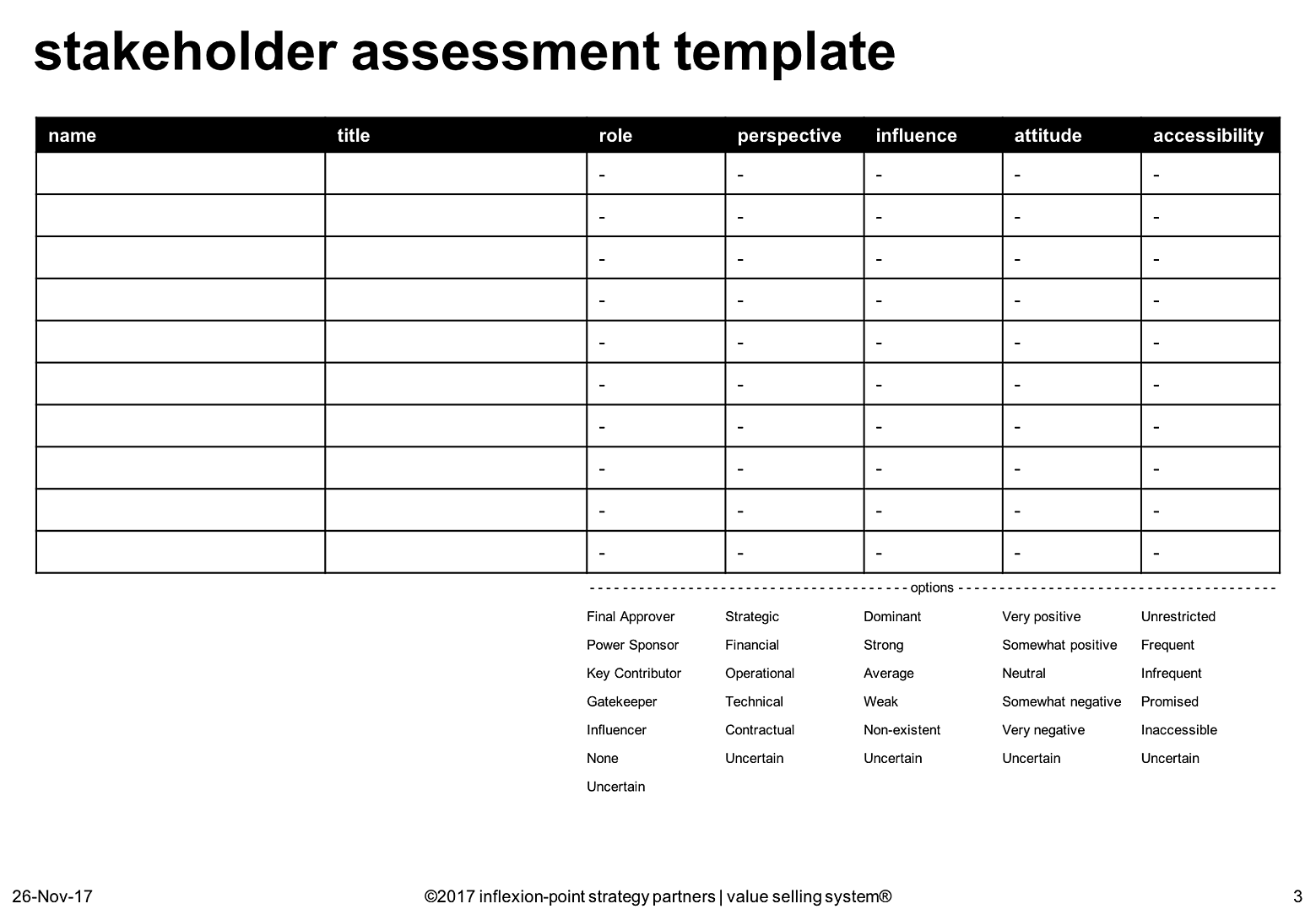

Once we have identified all the obvious stakeholders (and we need to be continuously on the alert for hidden stakeholders throughout the sales process), we need to carefully assess each of them in terms of:

- The role they play in the decision-making process

- Their predominant perspective

- Their influence on the final decision

- Their attitude to us

- Our access to them

Let’s examine each of these five key factors in more detail:

Role in decision process

Here are the most important roles in a typical complex B2B buying decision process:

- Final Approver

The project cannot proceed without their consent - Power Sponsor

Someone capable of driving the decision-making process and aligning the other decision makers around their preferred option - Key Contributor

A key member of the core decision group, with a significant contribution to make to the final decision process - Gatekeeper

Someone who has the potential to veto or delay the decision - typically on technical, commercial or legal grounds (e.g., IT, procurement or legal) - Influencer

Someone whose opinions are sought by the core decision group but who is not part of that group - None

Someone who does not fit into any of the above categories - Uncertain

We are currently uncertain about this individual’s role in the process

Stakeholders can sometimes play more than one role. In such situations, you should choose the ONE option that most accurately describes their most important contribution (for example, a power sponsor will inevitably also be a key contributor, but should be categorised as a “power sponsor”).

There may be multiple final approvers, key contributors, gatekeepers and influencers, but there will usually only be ONE power sponsor (and engaging with them and gaining their support is often critical to the success of the sale).

Predominant perspective

Stakeholders can look at the project through a number of different lenses or perspectives. These perspectives have a huge effect on the things they see as important. Here are the most common ones in a complex B2B buying decision process:

- Strategic

This stakeholder’s primary focus is on the long-term strategic aspects of the project - Financial

This stakeholder’s primary focus is on the financial or budgetary aspects of the project - Operational

This stakeholder’s primary focus is on the operational aspects of the project - Technical

This stakeholder’s primary focus is on the technical aspects of the project - Contractual

This stakeholder’s primary focus is on the commercial, legal or procurement aspects of the project - Uncertain

We are currently uncertain about this individuals’ primary focus

Recognising that some stakeholders may look at the project from more than one perspective, you should choose the one that seems to best reflect that individual’s primary focus.

In complex buying decisions, all of these perspectives will usually need to be represented within the decision-making group at a primary or secondary level. You should consider it a red flag if any of these perspectives appear to be “missing”.

Influence

It’s obvious in every complex B2B buying decision that some stakeholders have more influence over the outcome than others. Here are the ones that I encourage clients to use when assessing an individual stakeholder’s influence:

- Dominant

They have the power and authority to drive a decision through even in the face of opposition from other stakeholders - Strong

Their contributions are regarded as important to the ultimate decision - Average

Their contributions have some useful impact on the ultimate decision - Weak

Their contributions have a minor impact on the ultimate decision - Non-existent

Their contributions have no impact whatsoever on the ultimate decision - Uncertain

We are currently uncertain about their influence on the decision

Attitude

In addition to their influence on the decision, we also need to assess their attitude to us. Here are the ones that I encourage clients to use when assessing an individual stakeholder’s attitude:

- Very Positive

They have a very positive attitude to us and are actively championing our cause - Somewhat Positive

They have a generally positive attitude to us and appear to be actively supporting us - Neutral

They give no indication of being either in favour of or against us - Somewhat Negative

They have a generally negative attitude to us and may be supporting another approach - Very Negative

They have a very negative attitude to us and are likely to be actively championing an alternative approach - Uncertain

We are currently uncertain about their attitude to us

If a highly influential stakeholder appears to be highly negative to us, and assuming that we cannot outflank them, we need to work out if we can convert them. If not, we need to seriously consider whether it is worth pursuing the opportunity.

Accessibility

The final factor to assess is accessibility - how easy is it for us to directly engage with each stakeholder? Here are the ones that I encourage clients to use when assessing an individual stakeholder’s accessibility:

- Unrestricted

We have frequent and unrestricted access to this stakeholder - Frequent

We have relatively easy and frequent access to this stakeholder - Infrequent

We have only been able to have infrequent access to this stakeholder - Promised

We have been credibly promised access to this stakeholder but have not yet been able to engage directly with them - Inaccessible

Despite our best efforts, it appears to be impossible to access this stakeholder - Uncertain

We are currently uncertain about our ability to access this stakeholder

In many situations, we cannot reasonably expect to be granted unrestricted access to all key stakeholders. We will often need to work out how we can influence these stakeholders via and through other more accessible contacts.

An inexact science

It can be hard to reach an accurate assessment. It can be really dangerous to rely exclusively on direct questions to direct questions. We’ve all come across situations where people have over-played their role and importance in the buying decision process. We need to ask lateral questions and carefully cross-check the responses we get.

If an answer sounds too good or too convenient to be true, then it almost certainly isn’t. If the stakeholder group seems unnaturally small, or the decision-making process unnaturally simple, then we’re almost certainly missing a significant part of the picture.

It would be rare for all the above factors to be universally positive. We may have unrestricted access to someone who although they have a positive attitude to us is at best a fairly weak influencer. We may have to leverage positive relationships with some of the stakeholders to influence others that we cannot reach directly.

A fluid situation

And it’s just as important to recognise that some of these factors may be somewhat fluid. Some stakeholders may change their opinions. New stakeholders may be introduced, and some existing stakeholders may see their influence reduced (or increased).

We need to regularly reassess our position. But the fact that these assessments are inevitably something of an inexact science should not be taken as an excuse not to do them. Even a partially correct assessment is inevitably much better than proceeding in complete ignorance.

At minimum, I suggest that you start by identifying all the obvious stakeholders, and cross-checking to ensure that you haven’t missed anyone obvious. Keep looking out for new stakeholders, assess what you can about the ones you have identified, and come up with a plan to fill in the blanks.

If you’re involved in low value transactional sales with one or a few decision-makers, I can understand why you might think that the above approach is massively over-engineered (for your situation, it probably is). But if you are involved in high-value, high-stakes complex B2B sales with an inevitably large stakeholder community, I suggest that you cannot afford not to do the very best you can to identify and assess all the key players.

BTW, I’ve encapsulated this stakeholder assessment framework in a downloadable template. Please drop me a line if you’d like an editable version or would like any help in putting this approach into practice…

By Bob Apollo

Bob Apollo is the CEO at Inflexion-Point, the UK-based B2B sales and marketing performance improvement specialists. Inflexion-Point helps B2B organisations to design and implement highly effective customer acquisition systems based on a combination of the winning habits of their top sales performers and the latest industry best practices.

Inflexion-Point are the designers of the Outcome-Centric Selling Edition - a pre-configured Membrain version with sales process, methodology, and enablement embedded. This Edition will help your salespeople to make your way of selling into a competitive advantage.

Find out more about Bob Apollo on LinkedIn